I’ve found the filings on Google’s anti trial case a fascinating primer on adtech best ( and not so best) practices. The ruling is here in its entirety The DOJ’s case called Google’s ad tech business a “trifecta of monopolies,” with Google dominating publisher ad servers, ad-buying tools, and ad exchanges.

The whole case highlights specific practices around tying products, integrating user data and strict policies that shut out competitors helped the Google ad machinery extract huge profits from the ad ecosystem. The outcome of the remedies phase remains to be seen where the DOJ is seeking a possible breakup of the ads business.

Google’s massive $30+ billion ads business segment that matches website publishers with advertisers, pretty much rules over the web’s free content and any marketer even remotely involved in the ecosystem is impacted by this in some form or other. The gist of the case involves Google requiring publishers using its ads server to also use its ads exchanging effectively capturing inventory and shutting out competitors – essentially capturing the publishers side ( supply) and advertisers ( demand) and redirect ad revenue to its own properties Gmail, YouTube and Search which per the trial was 30-50% of every advertising dollar that passed through the supply chain.

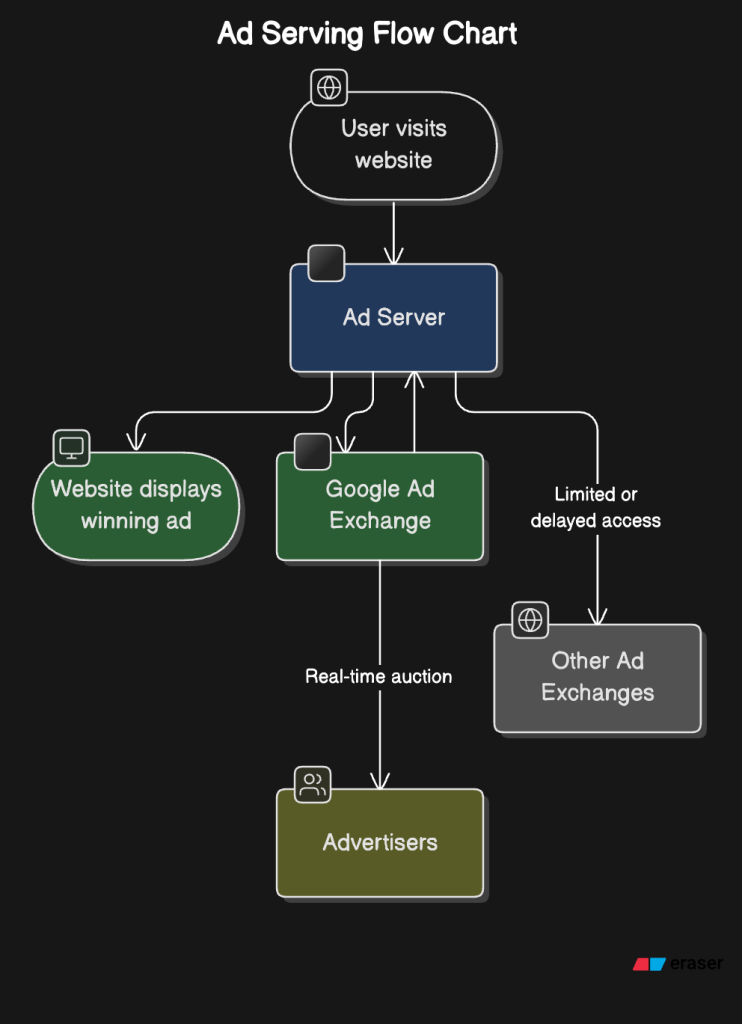

In simple terms, imagine you run a popular news site like CNN and you want to sell ad space.

- You use the popular Google ad server (DFP) to configure the ads that show up on the site. (Note – Google combined DoubleClick for Publishers (DFP) and DoubleClick Ad Exchange (AdX) in 2018 to the Google Ad manager. The naming saga continued through the years and is another testament to the fact on how convoluted all this is – like trying to untangle a pair of earphones that have been in your pocket since 2003.)

- Google makes a stipulation to you that in order to use Google ads via DFP, you need to also use the Google ad exchange (AdX) to sell your ad space.

- Other Ad exchanges ( like Trade Desk for example) find it exceedingly difficult to bid for your ad space due to:

- First Look: DFP gave AdX the first chance to buy every ad impression before other exchanges could even see it i.e. grab the the best inventory before anyone else. It’s like Google showed up for the 9 AM yard sale at 4 AM with a truck.

- Last Look: AdX could also see all other competing bids and outbid them in the end. The best example to depict this is sorta like Stone Cold Steve Austin’s entrance here.

- Limited Pricing rules for different exchanges means you could not give better deals to other preferred ad exchanges.

- Lack of feature parity between AdX and other exchanges gives you levers to block certain types of ads or advertisers but those levers are much more effective on AdX only.

The above events were interestingly set in motion by the FTC-approved Google’s acquisition of DoubleClick in 2008 for $3.1 billion with data and privacy concerns called out even back then dealing with the risk of Google combining data across all its services creating a unbeatable user profile for better ads targeting and a super power to dominate auctions. Its like the slow inevitability of a soap opera plot twist that is now in season 5, we knew it was coming.

Today’s ad tech ecosystem is convoluted mess of opaque, inefficient and hard-to-monitor practices with hordes of people, processes and tools that make it a complex system for any advertiser trying to maximize ROI while maintaining full customer consent and adhering to all privacy policies. In my own experience, sometimes trying to understand every element of the outcome of a particular campaign was like trying to assemble IKEA furniture using instructions written in binary.

The ruling could lead to a likely breakup but in any case is hopefully a harbinger of some welcome change to an ecosystem rife with monopolies and lack of transparency.